Los Angeles Times

By: Richard Verrier | September 30, 2012 | 2:23 p.m.

A broad coalition of unions representing the entertainment industry hailed Governor Jerry Brown’s decision to sign into law a two-year extension of California’s film and television tax credit.

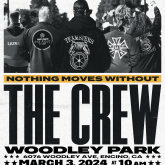

“We commend the legislature and Gov. Brown for recognizing that the motion picture business is an integral part of the economic and cultural powerhouse that has been California during the last 100 years,” said a statement issued by a coalition of entertainment industry unions, including the Directors Guild of America, the Teamsters, the International Alliance of Theatrical Stage Employees and SAG-AFTRA.

Brown approved legislation that was overwhelmingly supported by the state Assembly and the Senate. The bills provide $200 million for the state film tax credit, extending funding through 2017.

California offers a 20% to 25% credit toward qualified production costs, which employers can use to offset any business tax liability they have with the state.

Although the program is limited and not as competitive compared with what some other states offer, the bills were widely supported in the entertainment industry as a means of slowing the exodus of film and television production from California.

While the bills were expected to be approved, their support from the governor was not assured given the competition for scarce government resources. Backers originally pressed for a five year-extension, but that goal proved unrealistic.

“Unlike most other industries, ours is a highly mobile one — film and television production can be shot anywhere,” the coalition said in its statement. “Because of that reality, thousands of our members who live in California and want to work in California are dependent upon this state remaining competitive. We know firsthand that this program has created employment opportunities for them, and with that, health and pension coverage for them and their families.”